FAIRtax Calculator 3.0.24

Continue to app

Paid Version

Publisher Description

Although the FAIRtax Calculator is designed for anyone who wants to know how the FAIRtax would help them financially, it is primarily aimed at providing FAIRtax advocates a quick and easy tool, with which to show everyone from the man on the street to members of Congress, exactly how much any given family, of a particular size and annual retail spending, would pay in FAIRtax, once it becomes law.

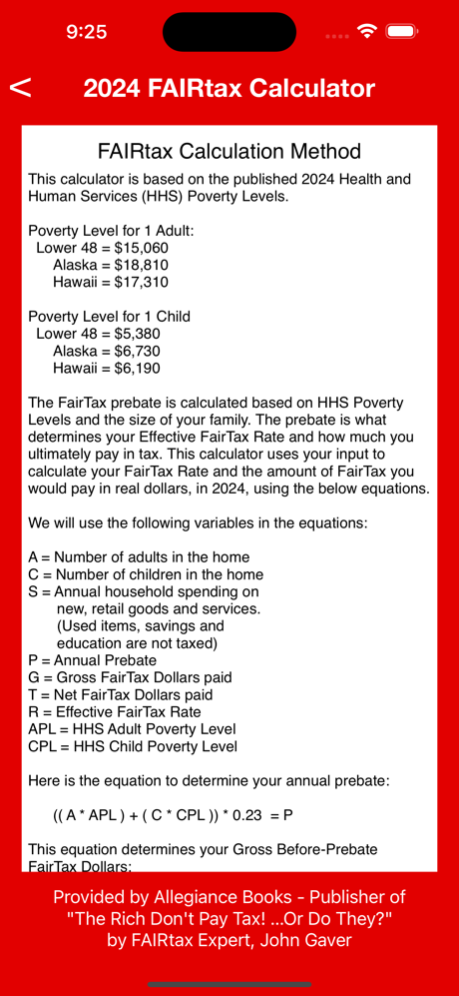

The current version of the calculator is based on the text of "The FAIRtax Act of 2023" (H.R.25) and the published Health and Human Services Poverty Guidelines for 2024. Each year, as the new federal poverty guidelines are published, this calculator will be updated to reflect those guidelines. (That data release usually occurs in early to mid January.) Also, should the wording of the FAIRtax Act be changed in its introduction in a future session of Congress, this calculator will be updated to reflect any relevant changes.

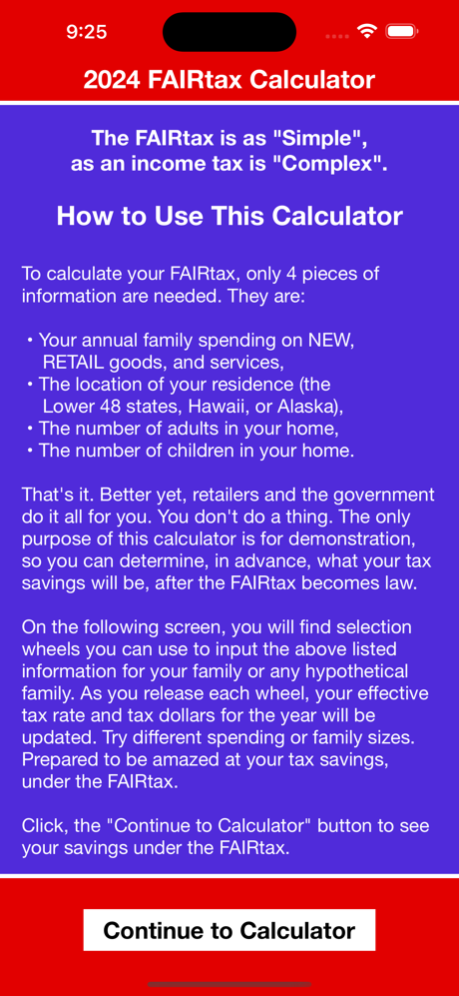

It should be noted that, since tax collection and rebate payments under the FAIRtax are all automatic (i.e. no federal filings for individuals), this calculator is FOR DEMONSTRATION PURPOSES ONLY. It is only to demonstrate what automatically happens “behind the scenes”. Under the FAIRtax, the only form you have to file is a one-page annual statement, attesting to the size and composition of your family.

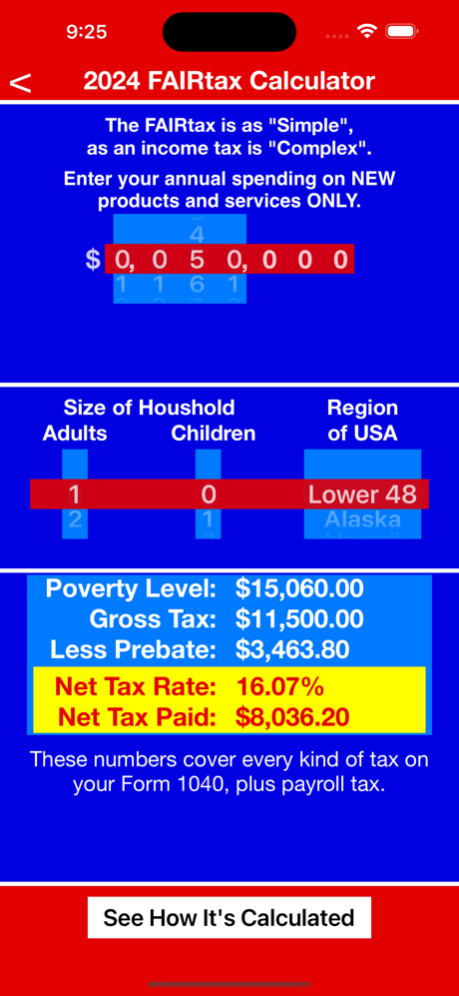

The FAIRtax calculator asks for the only four pieces of information, required to determine what you will pay in tax, under the FAIRtax. Those items are, 1) the family’s estimated annual spending on new retail products and services, 2) the number of adults in the home, 3) the number of children in the home, and 4) the region of the USA in which the family lives (Alaska and Hawaii have a higher cost of living, which would affect their rebate) - all done with scroll wheels. Selectable spending levels range in $1,000 increments from $0 to $9,999,000. Other wheels allow you to select the number of adults and children in the home and either the Lower 48 States, Alaska, or Hawaii. When you release each wheel, the tax total and tax rate numbers at the bottom of the screen are instantly updated.

The numbers at the bottom of the screen reflect the FAIRtax total that is equivalent to every item included on your current FORM1040 (income tax, FICA, Medicare, etc.). That tax level also covers both your personal payroll tax (7.65%) and employer portion of the payroll tax (7.65%), along with all federal income tax that is currently embedded in the price of products and services that you purchase, at retail.

Also included in this app is a screen that shows the underlying equations, used in the FAIRtax Calculator, in a scrolling page. Calculating the FAIRtax really is so simple that it can be accurately described in one page of text.

If you are a FAIRtax proponent, you'll appreciate the ability to almost instantly answer the question that all FAIRtax proponents have heard many times, "How much will I pay in FAIRtax?" In fact, with the ease and speed of the FAIRtax calculator, you can even encourage others to try to find any set of family dynamics for which the FAIRtax does not represent a benefit. As fast as someone gives you new numbers, you can show them the FAIRtax for that family, both as a percentage rate and in dollars.

Although this calculator is aimed at FAIRtax advocates, we invite FAIRtax detractors to try it. We invite you to play around with the numbers. Then compare the totals with what the same family would pay today, under the income tax. Then, you be the judge…

Jan 14, 2024

Version 3.0.24

This version is a two-fold release.

1) It is the annual update, that reflects newly announced HHS Poverty Levels for 2024.

2) It is also a major version update. We have added an additional piece of information to the results. The FAIRtax Calculator now includes a line showing the HHS Poverty Level basis for the given family, from which the FAIRtax Prebate for that family is determined. The Prebate is 23% of the Poverty Level for a given family. But with this number now displayed, it may help to better explain the Prebate and save the user from having to look up the HHS numbers or reverse the calculation to determine the number.

About FAIRtax Calculator

FAIRtax Calculator is a paid app for iOS published in the Reference Tools list of apps, part of Education.

The company that develops FAIRtax Calculator is John Gaver. The latest version released by its developer is 3.0.24.

To install FAIRtax Calculator on your iOS device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2024-01-14 and was downloaded 0 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the FAIRtax Calculator as malware if the download link is broken.

How to install FAIRtax Calculator on your iOS device:

- Click on the Continue To App button on our website. This will redirect you to the App Store.

- Once the FAIRtax Calculator is shown in the iTunes listing of your iOS device, you can start its download and installation. Tap on the GET button to the right of the app to start downloading it.

- If you are not logged-in the iOS appstore app, you'll be prompted for your your Apple ID and/or password.

- After FAIRtax Calculator is downloaded, you'll see an INSTALL button to the right. Tap on it to start the actual installation of the iOS app.

- Once installation is finished you can tap on the OPEN button to start it. Its icon will also be added to your device home screen.